How Trend Signals Can Revolutionize Your Crypto Trading

First things first: let's talk about signals in general. You've probably seen them all—RSI alerts, moving averages, MACD crossovers. While each has merit, none are as powerful as profitability trends.

Why? Because most other signals are reactive. They'll tell you what just happened but won't give you much insight into what will happen.

Trend signals, on the other hand, offer you a reprieve from the constant battle with the market's twists and turns. Instead of fighting against the wind, you can hoist the sails and let the trend carry you forward. It's a relief from the stress of constant market battles.

Why Trade Daily Timeframes, Not the 5-Minute Hype

Let's face it: Trading crypto on shorter timeframes is like trying to play dodgeball with a swarm of bees. It's chaotic, exhausting, and full of painful stings (otherwise known as whipsaws).

The daily timeframe offers you something magical: clarity. It smooths out all that intraday noise and volatility that can overwhelm traders. Sure, the 5-minute chart might feel exciting—you're glued to the screen, adrenaline pumping—but it's also a recipe for burnout and bad decisions. The daily timeframe gives you a clearer view of the overarching trend, reducing the risk of emotional decision-making.

The daily timeframe gives you a clearer view of the overarching trend. You're not bogged down by every tiny movement or "pump and dump" scheme. You make decisions based on data-driven trends, not knee-jerk emotional reactions. Plus, it's far more forgiving. Volatility is reduced, making it easier to manage risk.

In short, daily timeframes help you see the forest instead of getting lost in the trees. And in crypto, where volatility can feel like a full-time job, that perspective is worth its weight in Bitcoin.

Trends: The Universal Law of Success

It's not just crypto, where trend-following is the secret sauce. Trends are everywhere—from fashion to tech to the stock market. And here's the thing about trends: they're the closest thing we have to a crystal ball.

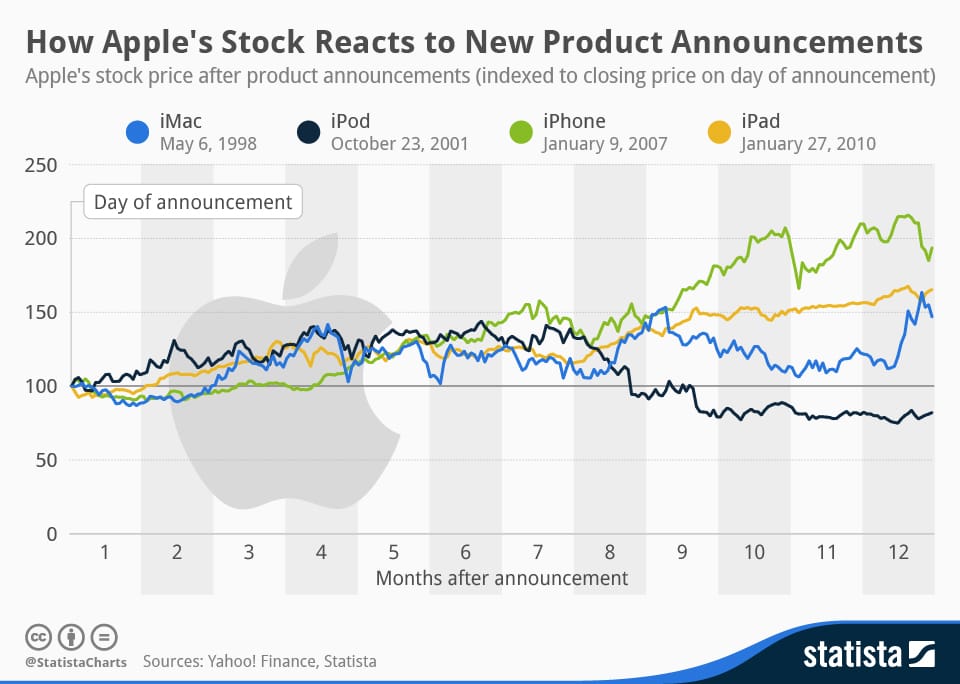

Let's look at some examples from the stock market.

Take Apple, for instance.

When the first iPhone launched in 2007, it wasn't just a new gadget; it was the start of a significant trend in mobile computing. Those who caught on to that trend early and invested in Apple stock? They've enjoyed astronomical gains since. It wasn't about following the Hype; it was about recognizing that Apple was leading a trend that would reshape how we interact with technology.

Or think about Tesla. For years, people wrote off electric vehicles as a fad. Yet, Tesla's stock followed a trend of increasing demand for cleaner energy solutions, autonomy, and futuristic tech. The stock exploded not because it was hyped overnight but because it rode the wave of a growing trend that people finally started waking up to.

Crypto is no different. When a coin or token begins trending, it's because there's something bigger at play. Whether it's a new use case, a massive adoption, or even a meme-fueled craze (we see you, Dogecoin), understanding the trend is where the real opportunity lies.

Following Trends in Crypto vs. Commodities

Now, let's compare commodities to stocks. Like stocks, commodities like oil or gold have long-term trends influenced by supply and demand, geopolitical events, and global economic shifts. In the same way, crypto assets often follow trends driven by network effects, technological adoption, or regulatory changes.

The key to winning in both is recognizing the trend early. Like oil traders who saw the impact of new energy policies or stock traders who saw the potential in Apple's iPhone revolution, crypto traders can capitalize on trend signals to maximize their profits. It's about being proactive, not reactive.

Why Trendindicator.pro Is the Hero You Deserve

You're in luck if you're wondering how to catch these trends without becoming a full-time analyst. Trendindicator.pro is here to take the guesswork out of it. Instead of chasing your tail reacting to every minor blip on the chart, this tool identifies major trend shifts for you. It's like having a seasoned sailor at the helm of your ship, navigating you through the stormiest of crypto seas with ease.

With Trendindicator.pro, you can:

- Trade smarter, not harder. Stop obsessing over every tiny price movement and focus on the big picture.

- Mitigate risk: By trading on a higher timeframe, you'll avoid unnecessary volatility and emotional decision-making.

- Ride profitable trends: Trend signals align you with the market's general direction so that you can ride trends from start to finish—just like the savvy Apple and Tesla investors.

Ultimately, trend-following isn't just a strategy—it's the difference between guessing and trading with confidence. Whether you're a seasoned trader or still figuring out what RSI stands for (Relative Strength Index, by the way), trend signals are your key to consistent profits.

So, take a step back the next time you're tempted to jump on a random signal from Twitter or dive into a 5-minute chart frenzy. Breathe. And let trend signals show you the way.

After all, the trend is your friend.