How I Achieved a +60% Gain Amidst the Crypto Market Crash

Monday was tumultuous for the crypto market, with widespread panic and significant losses. According to Binance, the crash was driven by regulatory concerns, macroeconomic factors, and large-scale liquidations. However, amidst this chaos, I secured a +60% gain.

But let’s start with what happened on August 8, 2024.

The Crash

The crypto market experienced a dramatic downturn on August 5, influenced by multiple global factors. Rising fears of a U.S. recession, triggered by increasing unemployment rates, led investors to withdraw from risky assets like cryptocurrencies. Simultaneously, Japan’s Nikkei 225 index plummeted following a rate hike by the central bank, spreading fear across global markets. Additionally, escalating geopolitical tensions in the Middle East contributed to market instability, resulting in significant losses for major cryptocurrencies and global stock indices.

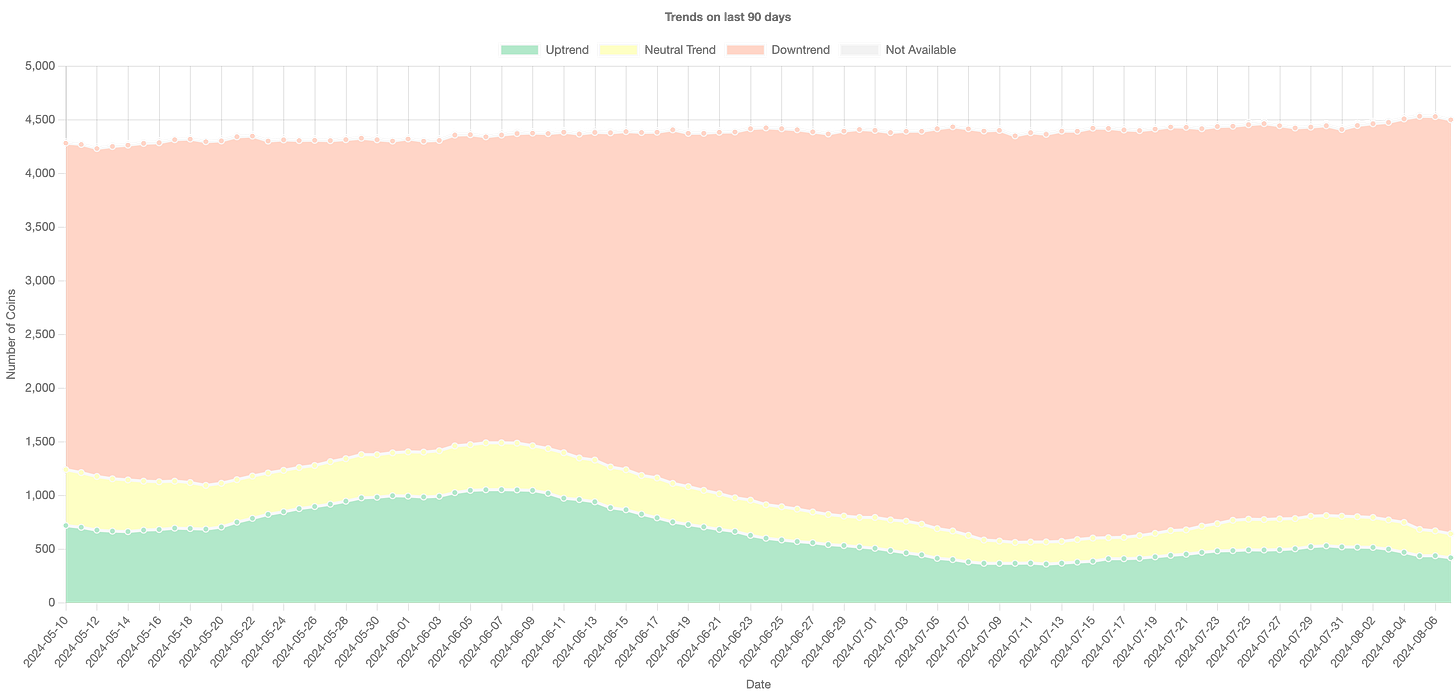

The crypto market was already in a downtrend, right?

Yes, it was.

Every day, a public report about the current crypto market trend is available on

https://trendingcoin.app/#market

The trend was very bad: 84% (3.849 out of 4.539) of coins were in a downtrend.

As you know, there’s always an occasion (or asymmetry) in the crypto market, but it’s difficult to spot the right ones without a tool or actionable insights.

My Secret Weapon: TrendingCoin

I developed Trendingcoin to provide accurate signals based on daily data about the overall market trends.

The app applies the algorithm behind Trendindicator Pro, an Indicator I built on Tradingview when I started my trading journey.

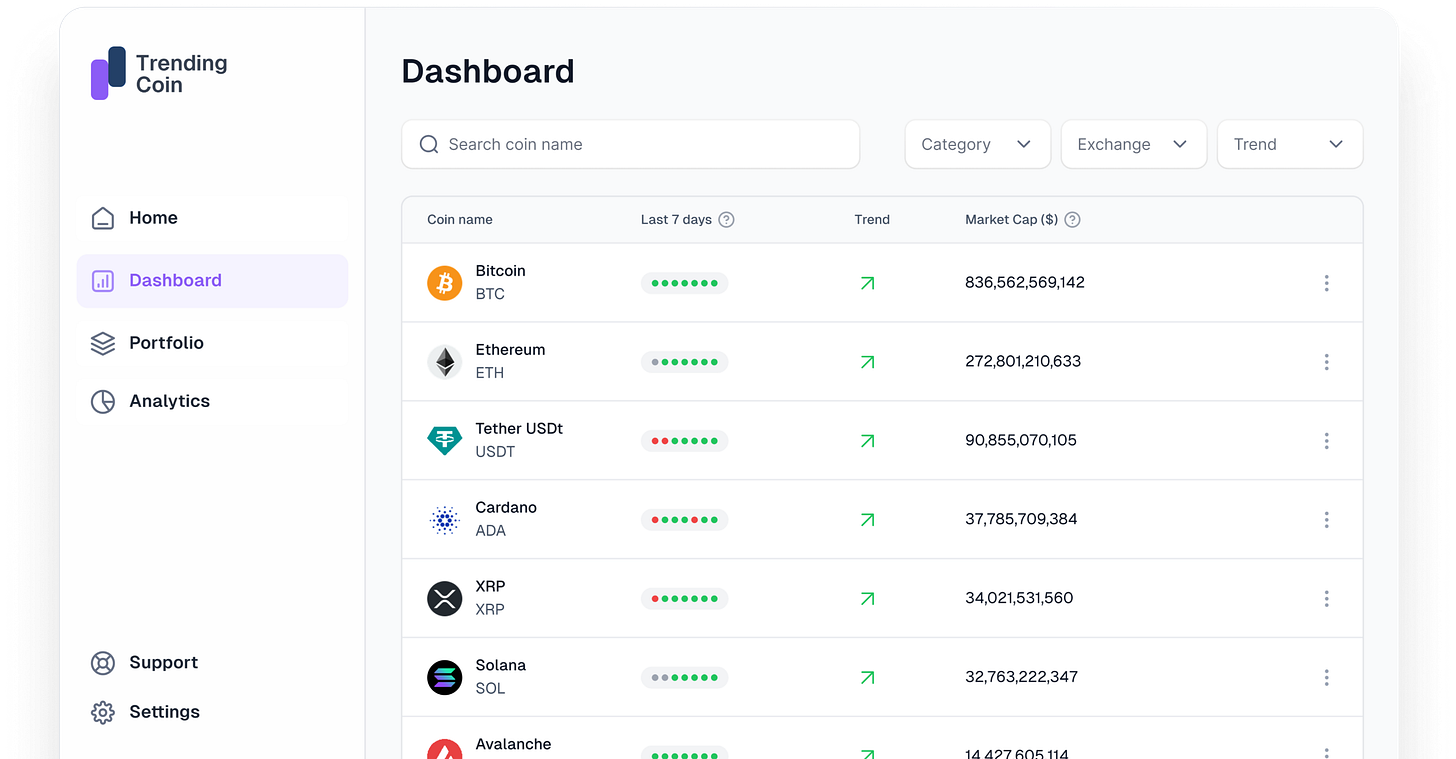

I use it to receive precise trend signals across 4000+ coins, identifying optimal entry and exit points. One of the app’s standout features is the scoring system, which assigns a score based on the strength of a coin’s trend. This scoring system is crucial for both uptrend and downtrend coins, helping users make informed decisions.

Additionally, TrendingCoin’s algorithm suggests when to profit in both uptrend and downtrend markets. This feature enhances profitability for long and short positions, ensuring users can capitalize on market movements effectively.

How I gained 60% just holding a coin

On this particularly volatile day, the app flagged that GFT (Gifto) had a positive score, indicating it was trending upwards despite the overall market downturn with an increased trade volume.

Despite GFT turning in an uptrend 6 days earlier, and it was present in my score dashboard, I was not entirely convinced to open a position in GFT because the previous scores I got were really low (1–10).

But on the fifth morning, when I opened the app, the score was >700, a clear sign that something was moving more than expected.

Call it luck, but the worst day in months for the crypto market was the best for GFT, with a massive increase of 62.67% during that particular day.

As you can see from the screenshots, Trendindicator Pro (and the Trendingcoin App) suggests when to take profit, and that 60% green candle was one of those moments.

Could I’ve gained more?

I waited until the daily candle closed (02:00 AM in the Rome timezone), and, this time, I decided to take profit on the entire position without leaving anything on the table just because of the nature of this absurd pump. Still, looking back at the GFT chart, I noticed that, from the beginning of the uptrend (that I didn’t consider), I missed another two clear take profits signals (+11% and +14%).

I could have gained 120% in 5 days, that compared to the auto stop-loss level suggested by my indicator (-12%) was a nice 10:1 risk-reward proportion.

Of course, it’s easier to analyze it afterward, especially when things go well, but I’m happy to have built a process that helps me trade more confidently.

If you’re interested in my trading process, I suggest you visit Trendindicator Pro and TrendingCoin and subscribe to our daily market update newsletter from this page.