How I Stopped Relying on Social Media Influencers for Crypto Signals

Let's face it: we've all been there, scrolling through Twitter (sorry, X), Reddit, or YouTube, waiting for the next crypto guru to drop the "hottest" altcoin that will indeed send us to the moon.

It sounds like a perfect plan, right?

Follow the advice of someone with thousands of followers, buy when they say "buy," and watch your portfolio soar.

Here's a surprise—it doesn't always work.

For me, it led to a wild ride of stress, bad choices, and regrets. So, how did I finally stop relying on social media influencers? And more importantly, how can you do the same? Get ready because we're about to explore how I learned to trust data, rely on myself, and use some tech magic.

The Problem: Emotional Trading and the Influence of Influencers

Let me paint you a picture: You're sitting at your desk, casually sipping coffee, when you get a notification. It's your favorite crypto influencer who just posted a video titled "This Altcoin Will 10x in 2024!" Your heart races, and without a second thought, you rush to buy the coin before it skyrockets.

What happens next? It pumps a bit, and you hold on too long, watching it crash back down or tank immediately, leaving you with a heavy bag of regrets.

Why does this happen? Because trading based on someone else's hype is like playing poker with someone else's hand. You don't know their true intentions, risk tolerance, or the full context of their trades. And even if they're being genuine, they could still be wrong. Every market is unpredictable, and no influencer—no matter how many followers they have—can consistently tame it.

Recognizing the Need for a Strategy (And Deleting X)

After getting burned one too many times, I realized I needed to stop following the herd and forge my own path. I'm a software developer by trade, so naturally, I started thinking about using data, trends, and a bit of automation to make better trading decisions.

The first step was to admit that I relied too much on influencers and not enough on my research. So, in a bold move, I completely deleted my X account. No more endless scrolling through tweets, relying on hype, and no more FOMO.

It was time to build a system that allowed me to trade confidently without checking social media every five minutes.

Data-Driven Tools to the Rescue

As a software developer, I built tools to help me take a systematic approach to trading. This helped me shift from emotionally driven decisions to a more data-driven approach.

But It wasn't easy.

I started browsing an endless list of trend-follow indicators, going deep into technical analysis, and wasting a lot of time experimenting with a mix of signals and indicators to find the perfect strategy for success.

Then I remembered that I was a software engineer again, and I applied the KISS principle (Keep it simple, stupid)

So, I developed a simple trend-following indicator that gives me just 3 signals: UP, DOWN, and NA(unavailable). Then I tried backtesting, and although I got some considerable gains in theory, I realized that the drawdown was too high in most of the trades.

To mitigate this, I added a simple but effective stop-loss suggestion and a suggested take-profit level. In this way, my only task as a human is to evaluate the right project to invest in. The strategy will do the rest.

Minor issue: Addiction to TradingView

I've just built an indicator and a strategy, and the market offered thousands of coins to backtest it. Result?

I spent hours on TradingView testing coin per coin, searching for a suitable timeframe for each, backtesting, and taking notes.

I was exhausting my brain, and I felt like a zombie at the end of the day.

I built another tool again.

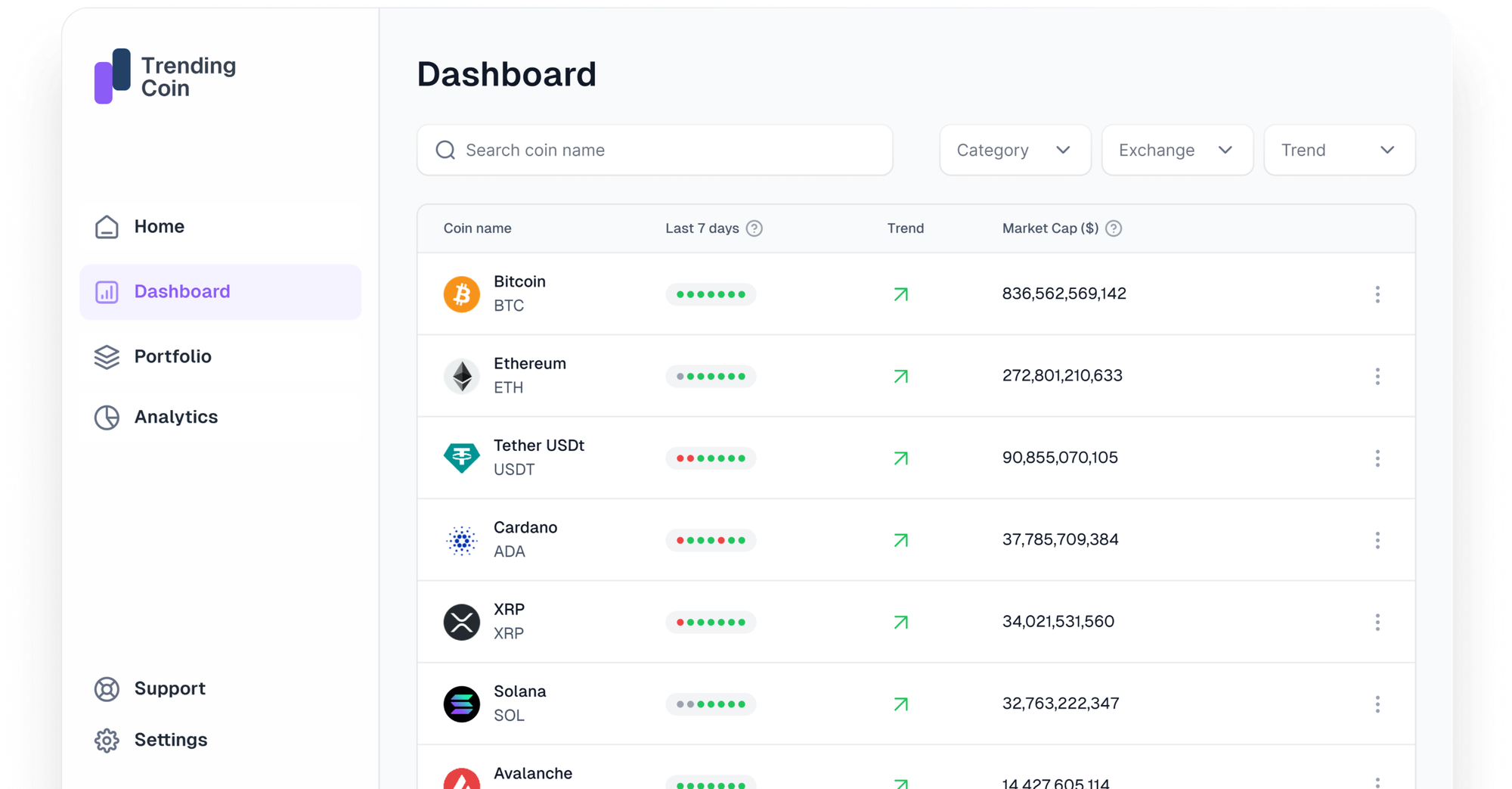

I put the source code of the indicator I built into an app that scans thousands of coins and tells me which one is trending, the overall market status, and occasions to buy and sell.

I spent months building Trendingcoin, and now it's publicly available (and have also a decent UI)

Now, I spend 2 to 5 minutes a day just checking the app on crypto. If I decide to invest in something, I know exactly when to put a stop loss, and Trendindicator Pro (oh, that's the name of the indicator I built earlier) will alert me when I need to take profit or exit the position.

The Results: Peace of Mind and some profit as well

I won't pretend that I became a millionaire overnight (or at all), but I did start seeing more consistent profits.

More importantly, Now, I trade with a lot less stress.

There was no more panic selling when an influencer flipped their opinion, and there were no more FOMO-induced buys.

Instead, I was sticking to a strategy, using tools that gave me insights grounded in reality, not hype. I was finally in control of my trades, and it felt good.

Stop Chasing the Hype

If you've been relying on social media influencers for your crypto signals, it's time to take a step back and reassess. While some influencers provide valuable insights, they shouldn't be your sole source of information. The crypto market is too volatile and unpredictable to navigate based on tweets and YouTube videos alone.

Instead, focus on building a data-driven strategy.

Tools like Trendindicator Pro and Trendingcoin can give you the edge to make informed decisions and trade confidently.

And who knows? Your portfolio and peace of mind might just thank you for it.