How to Set Effective Stop-Losses and Take Profits in Crypto Trading

At least what I hard-coded into my tools

If you’ve ever tried crypto trading, you know it can be chaotic, with prices soaring and crashing quickly. Without a solid plan, your profits can disappear fast. But there’s a way to improve your trading success: by using stop-losses and taking profits.

Let’s explore how these strategies can make your trading decisions more effective and less stressful.

The Power of Stop-Losses: Protecting Yourself from Surprises

One of the hardest parts of trading is knowing when to cut your losses. We’ve all hoped for a market recovery, only to see it drop further. Stop-losses come here — they’re your safety net in a volatile market.

I use a method involving the Average True Range (ATR) multiplied by 2 (ATR*2). The ATR measures a coin’s price volatility over time. By multiplying it by 2, you create a buffer against normal price swings, reducing the chances of your stop-loss being triggered by random market fluctuations.

This method is flexible. You might increase the multiplier for highly volatile coins to give your trade more space. For more stable coins, you might reduce it. The key is to adjust based on the coin’s behavior. I usually use a range between 2 and 2.5.

Why Hitting a Stop-Loss Is Okay

Hitting a stop-loss can feel like a loss, but it’s a sign that your strategy is working. It means you’re sticking to your plan, managing risk, and protecting your money.

On the other hand, revenge trading — trying to win back losses immediately — is driven by emotions, not strategy.

Emotions have no place in trading.

That’s why I built Trendingcoin: to help me (and you) spot opportunities without needing constant chart analysis so you don’t trade out of frustration.

In crypto, patience is crucial. Stick to your plan, trust your stop-losses, and remember that missing one trade doesn’t mean missing the next. The market is full of opportunities.

Taking Profits: Locking in Your Gains

Now, let’s talk about taking profits. Watching a profitable trade turn into a loss is frustrating because you didn’t secure your gains. That’s why having a clear take-profit strategy is crucial.

I use two methods for this.

The first is part of my Trendindicator Pro secret sauce, which helps spot the peak of each mini-trend. This method helps you exit a trade with part of the gains in a top-like momentum just before the trend can lose its strength.

Of course, nobody can know when the Top is, but the method I use is a very helpful guideline.

The second method involves the “Casual Pump/Dump” (or Price Anomalies).

If the price exceeds the standard deviation by two times, I’ll take profits. This captures sudden, explosive market moves.

I usually withdraw 20% of my position and continue securing profits as the market trends in my favor.

Why These Strategies Work

By using stop-loss and take-profit strategies, you manage risk and maximize gains. Stop-losses prevent a bad trade from wiping out your account, and take-profits help you secure gains before the market can take them away.

These strategies won’t eliminate losses entirely but will help you stay disciplined and consistent. Over time, this makes the difference between a profitable trader and always chasing losses.

Take profits to boost your profitability.

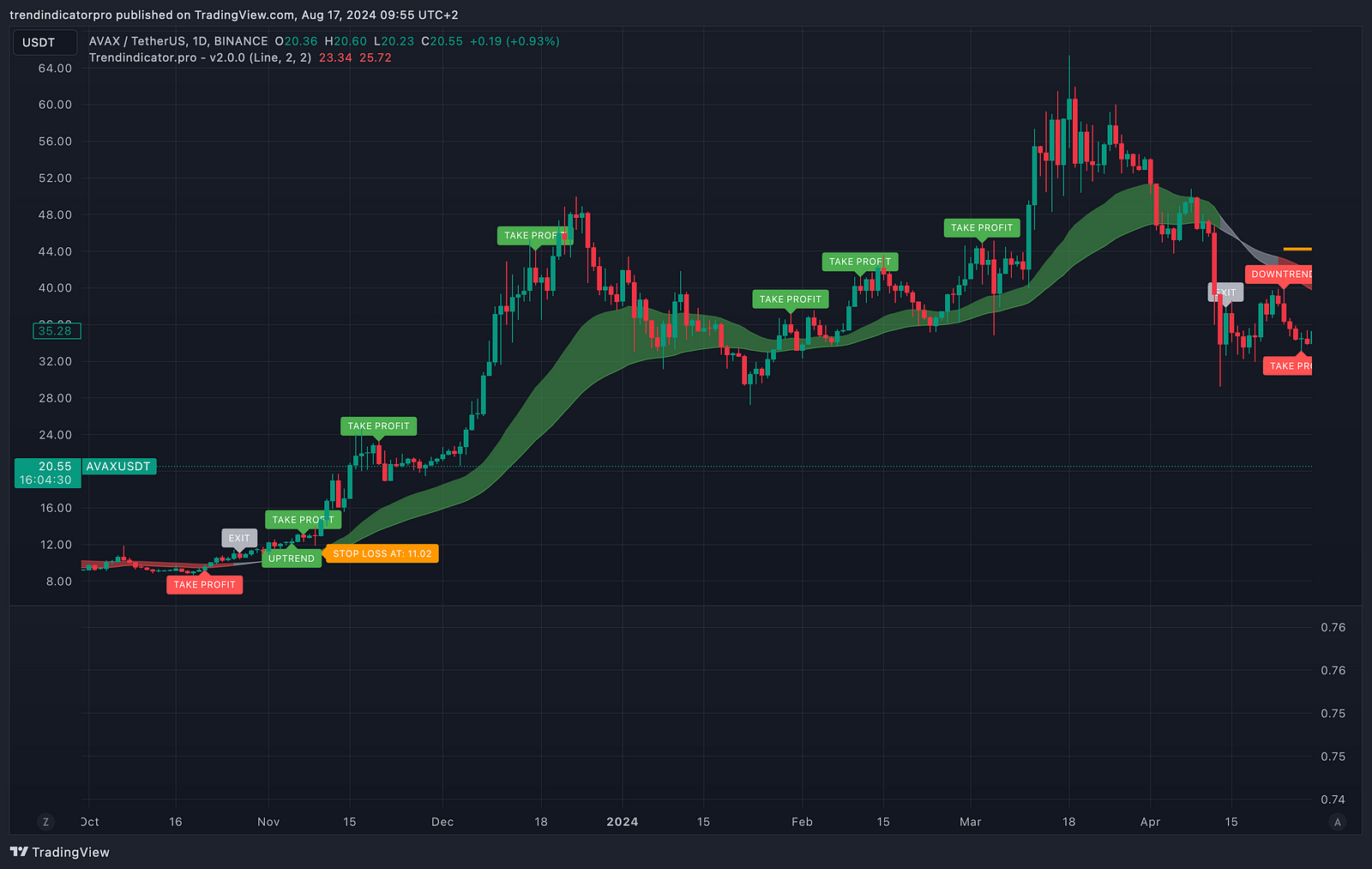

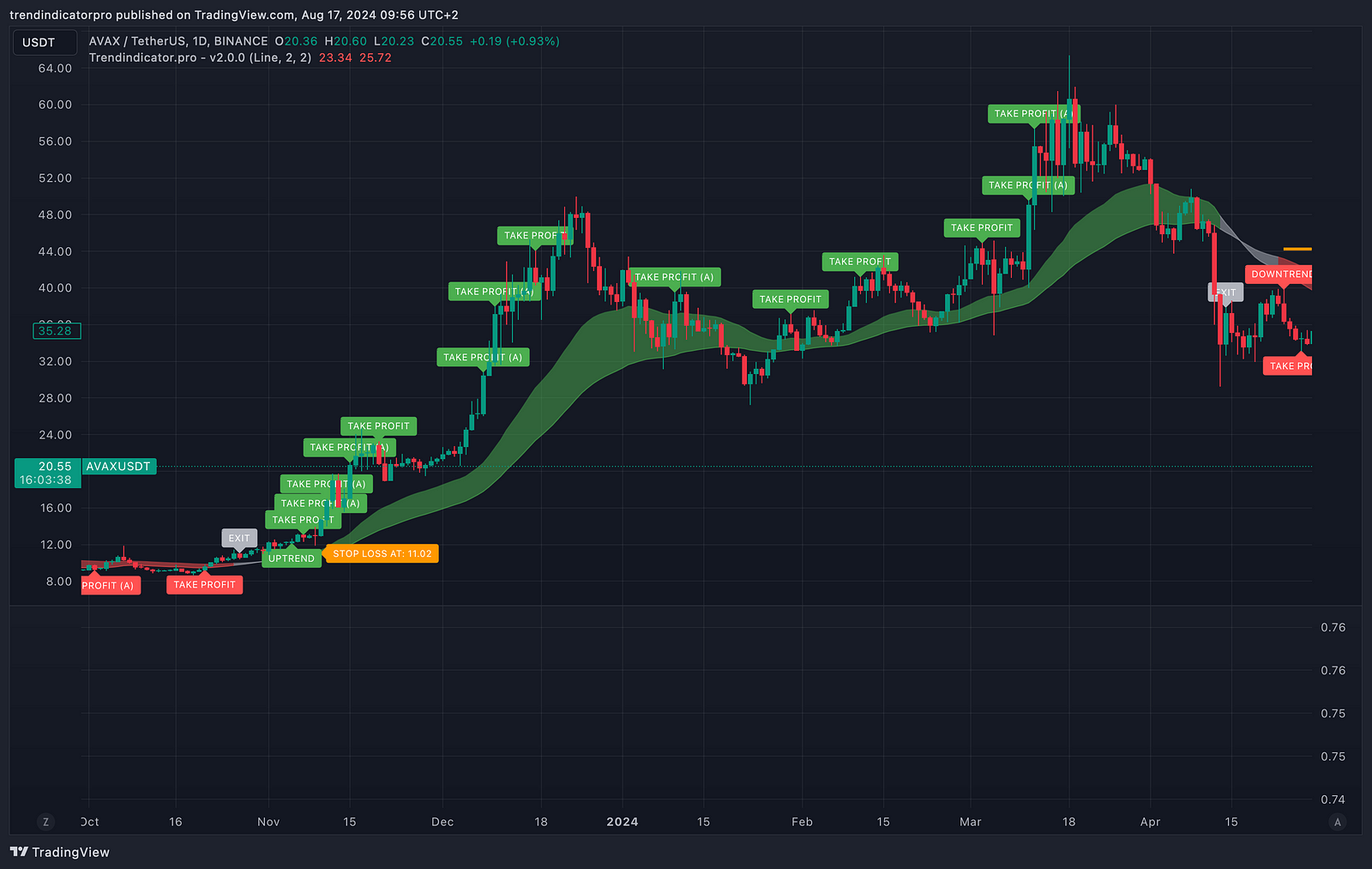

Let’s take the AVAX/USDT chart, but not in the ideal scenario (like the one above)

From 2023/03/23 to 2023/11/01, Trendindicator Pro detected a not-successed uptrend followed by a downtrend.

Now, we will simulate a trend following a trading approach without and with taking profits.

Without take profits

- The first “fake” uptrend caused us a 10% loss on trend reversal.

- Shorting the downtrend caused a 23% overall gain.

- This trade was 66.7% profitable, with a drawdown higher than the average trade. We got lucky.

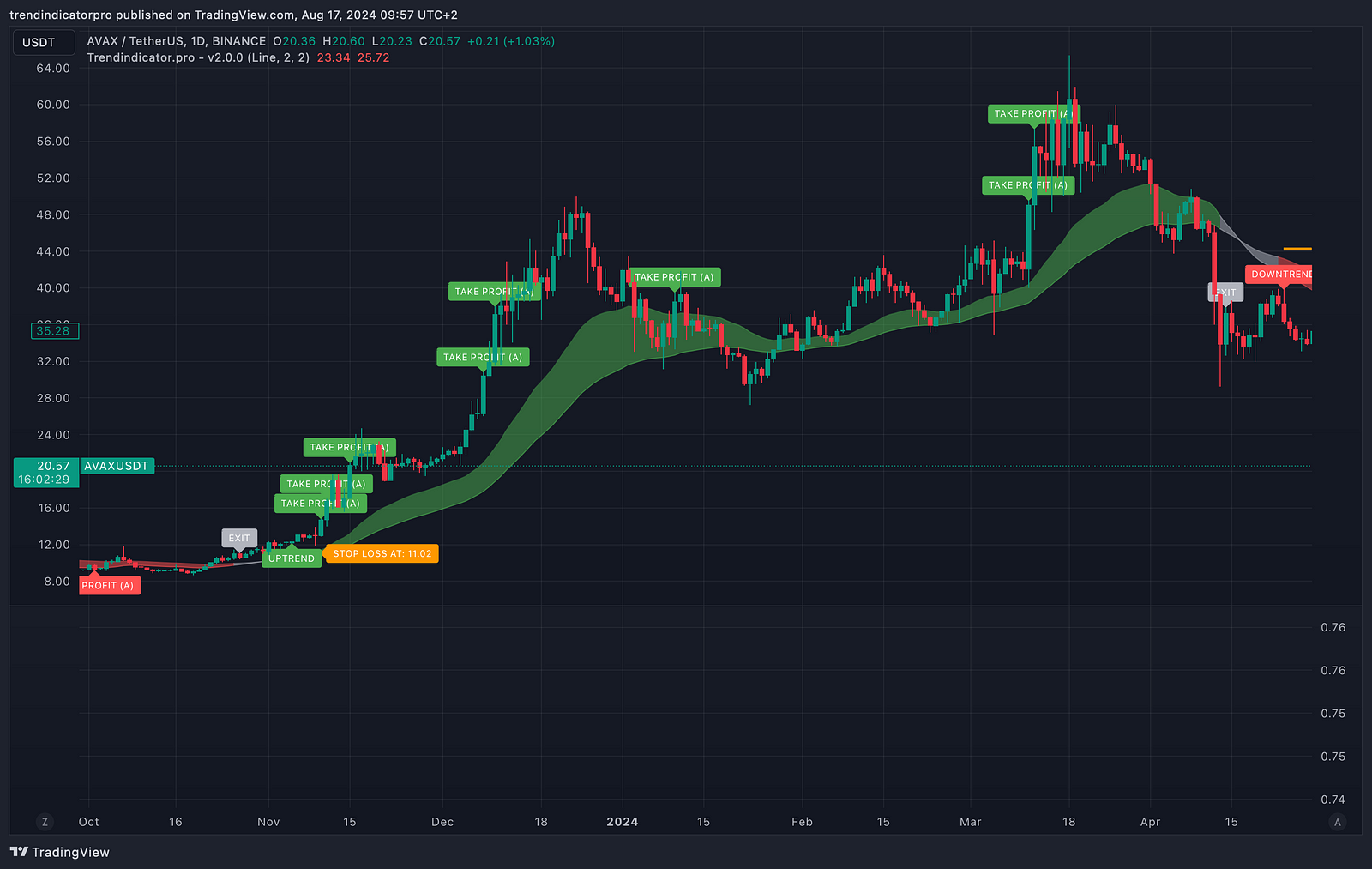

With take profits enabled

- The first “fake” uptrend caused us a reduced 7% loss on trend reversal because we took profits (15% from uptrend detection)

- Shorting the downtrend caused a 28% overall gain.

- This trade was 93.3% profitable, with a drawdown lower than the average trade.

- We took profits over the “fake” uptrend and down to the downtrend.

Successful trading means having better odds on your side than the market’s and having a process that can achieve 93% by using take profits instead of 67% makes me more confident while trading.

Final Thoughts

Crypto trading isn’t easy, but with the right strategies, it doesn’t have to be a wild ride. Setting stop-losses and taking profits can reduce uncertainty and improve your chances of success. Remember, trading isn’t about predicting the market; it’s about managing your trades to give you the best chance to succeed.

So, before you make your next trade, have a plan for when to cut losses and lock in gains. Your future self and trading account will be glad you did.