I Built a Crypto Trend Strength Score System, and It Works

As a software developer with a penchant for side projects (and a bit of a crypto obsession), I’ve spent countless nights wrestling with trading strategies. After numerous iterations, dead ends, and coffee-fueled coding marathons, I finally built something that works—a trend strength score system. And yes, it’s as cool as it sounds.

The Problem with Emotion-Driven Trading

Before diving into the nuts and bolts of my trend strength score system, let’s talk about the elephant in the room: emotional trading. If you’ve ever dabbled in crypto, you know that emotions can be your worst enemy. The thrill of watching your portfolio skyrocket, followed by the gut-wrenching plunge—is enough to make anyone reach for the “sell” button at the worst possible moment.

The issue is simple: emotions cloud your judgment. And in a market as volatile as crypto, relying on your gut feeling can turn a promising investment into a financial faceplant. But with a data-driven system like the trend strength score, you can finally breathe a sigh of relief, knowing that your decisions are based on solid, quantifiable data.

Enter: Trend Strength Scores

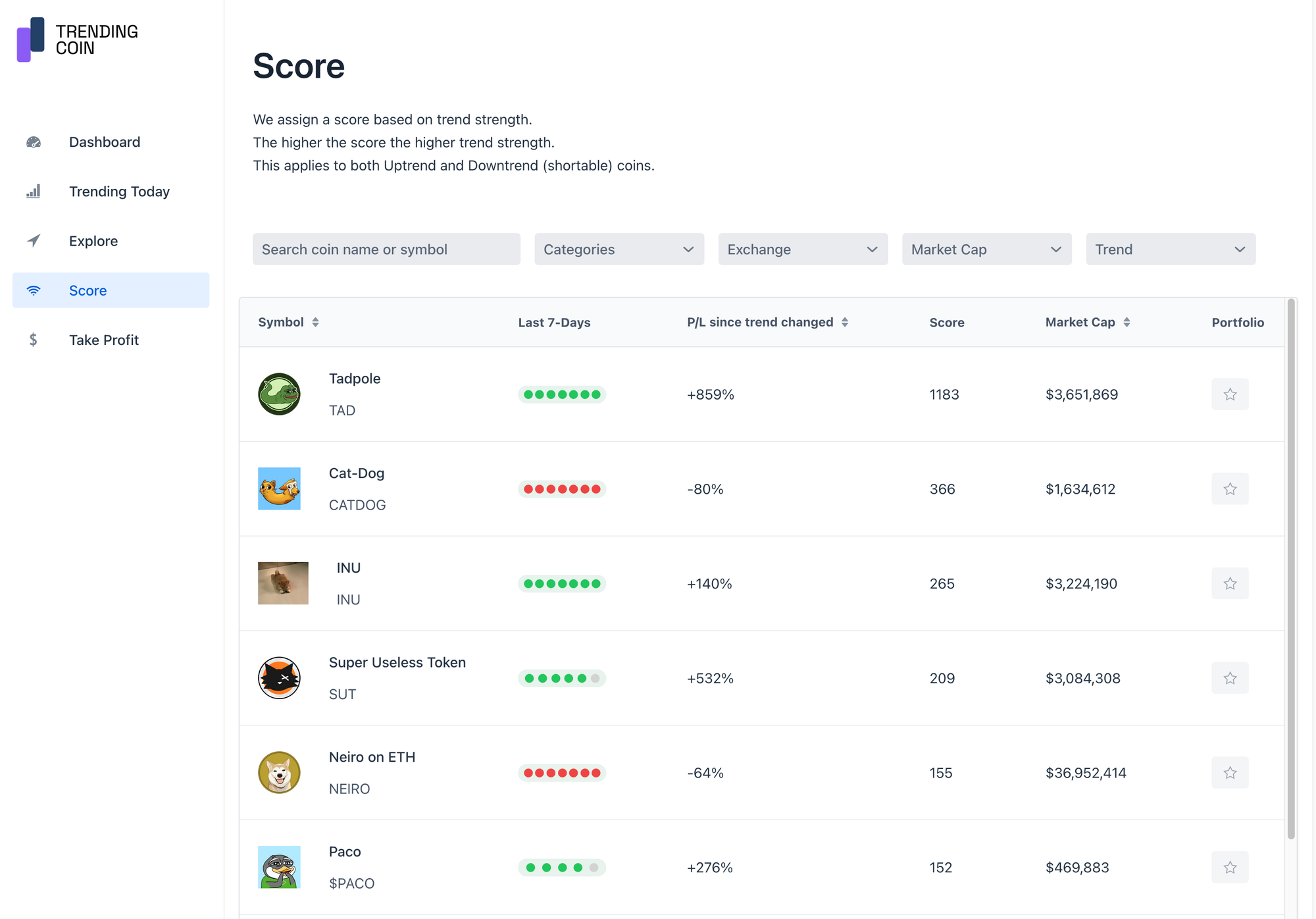

So, how do you take emotions out of the equation? You turn to data. Specifically, you look at trend strength scores. These scores quantify the momentum of a crypto asset, giving you a clear, numerical value that tells you whether the trend is bullish, bearish, or somewhere in between. This system gives you a sense of control, empowering you to make informed decisions.

Think of it as the trading equivalent of a weather forecast. You wouldn’t plan a beach day without checking the weather. So why trade without knowing the strength of the trend?

My First Bet: A Meme Coin Gamble

Now, let’s get into the real-world application. My first experiment with the trend strength score was with a meme coin on Solana. Why? These days, the market is flooded with opportunities in memes, and honestly, it feels like the Wild West out there.

Meme coins are like gambling—yes, but not if you filter them appropriately. Let me explain. Tons of meme coins are created daily, most of which are just pump-and-dump schemes. To avoid these traps, I rely on my app feed. My app, Trendingcoin, receives official data from Coingecko, which lists new coins in their Crypto API only after a pre-filtering process by their team. This pre-filtering is crucial because it ensures I only consider meme coins with decent volume and market cap.

Of course, this means I won’t catch the 1000x moonshots that the luckiest meme coin holders brag about. After all, it usually takes 1-2 weeks before the Coingecko team lists a meme coin in their API. But that’s a trade-off I will make for a little more security.

Once a coin is listed, I use the Trend Strength score I built within Trendingcoin. This score filters for coins that are seeing rapid changes in volume—up or down—daily, often before the uptrend is confirmed by my algorithm. This way, I can narrow down my watchlist to 3 to 10 projects daily. Today, 90% of these coins are meme coins, but they could be more diverse in a bull market. If one of these coins appears in the score section for 2-3 days, it’s time to buy.

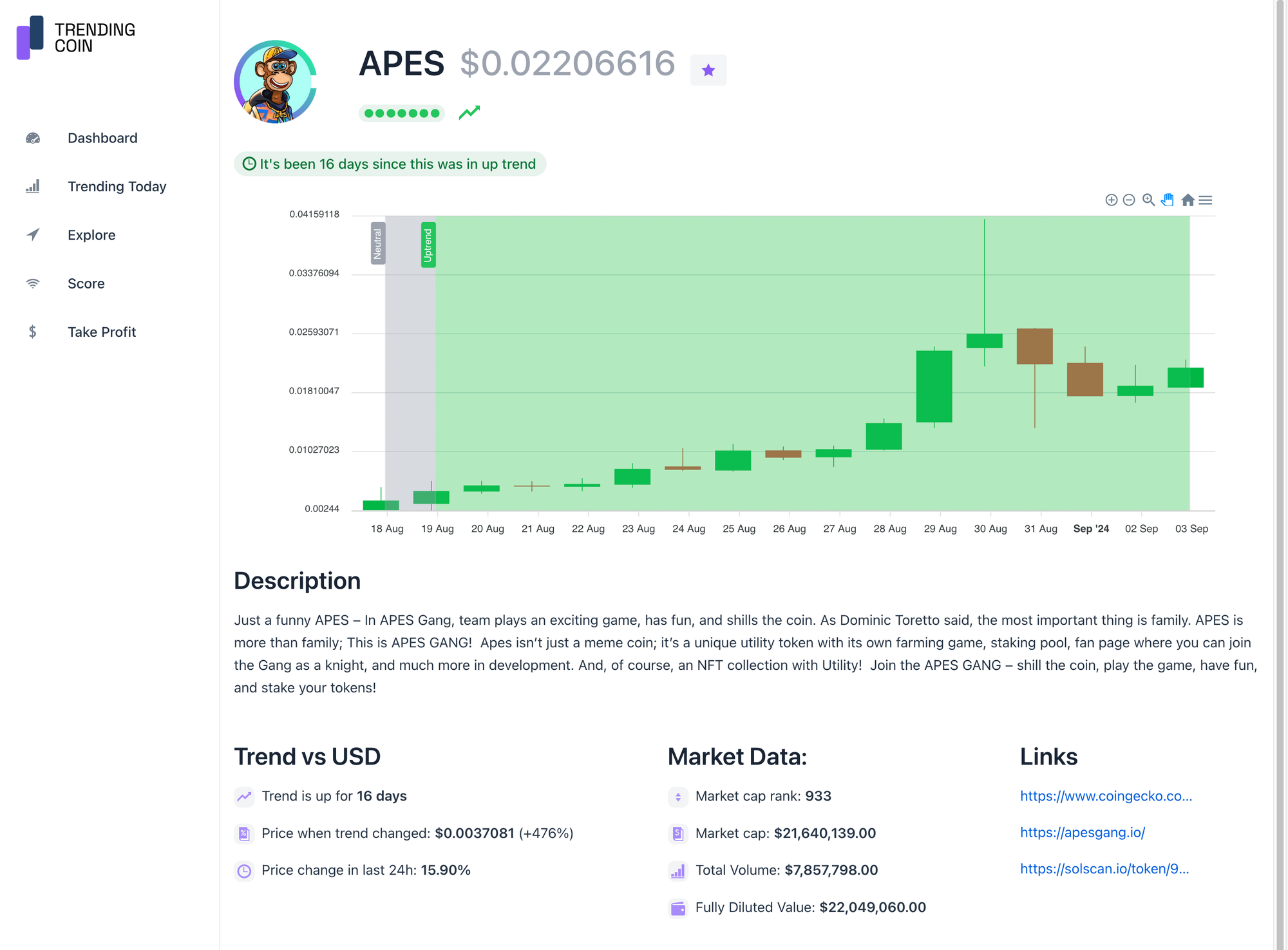

The Second Test: My $157 Gamble on APES

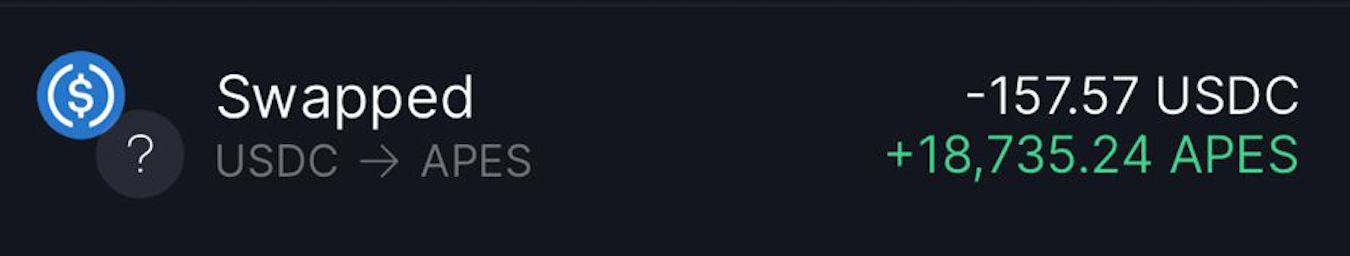

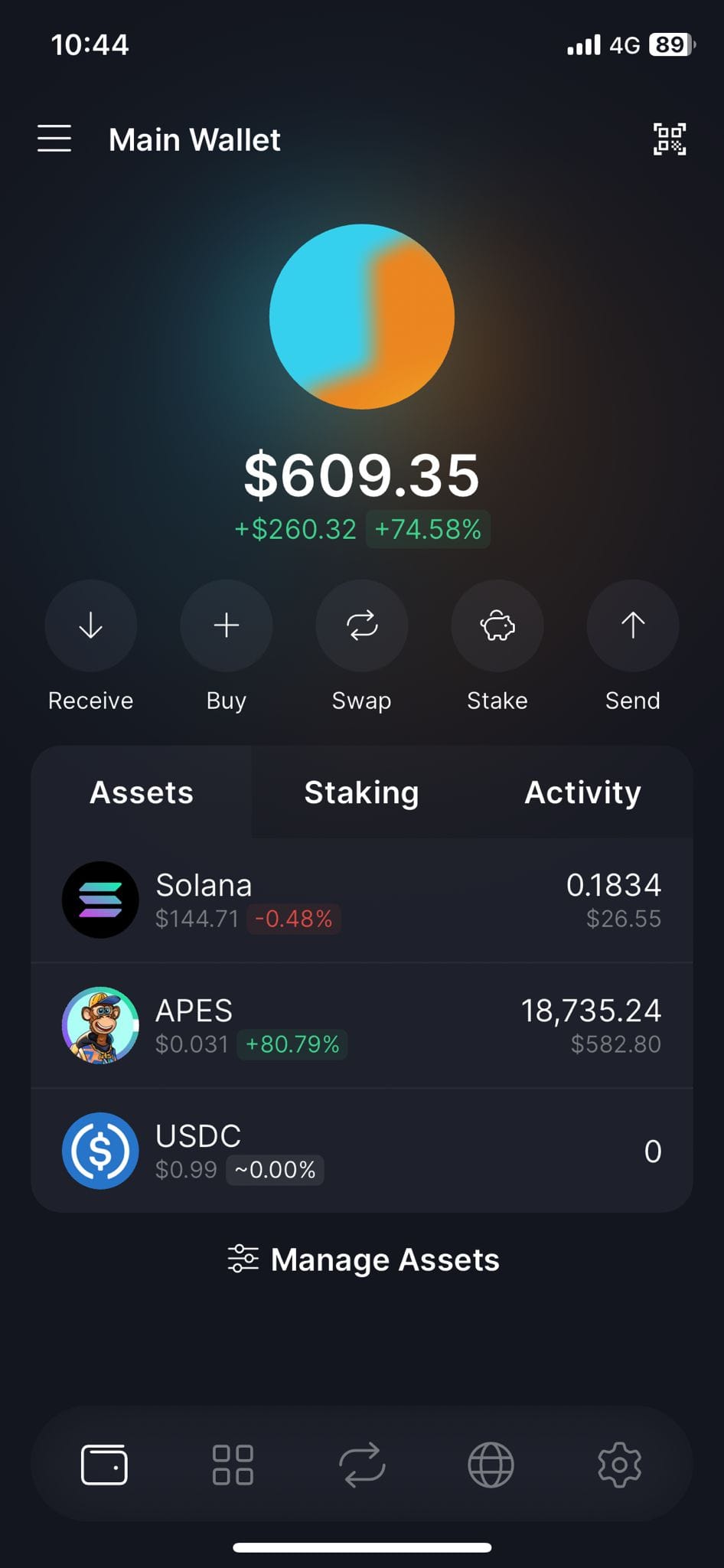

So, after watching many meme coins in my score section pump 300-400% in just a few days without jumping in, I decided it was time to put my method to the test. I loaded up my Solflare wallet with $200, picked up $157 worth of APES (I liked the number), and then waited a few days.

Now, let’s be honest—selling at the top is impossible. When my $157 ballooned to $600 in two days, I was seriously tempted to cash out. However, I stuck to my process and decided to take profits only when my app gave me the signal. This patience, guided by the trend strength score, allowed me to make a calm and calculated decision. The retracement happened at $0.22, so I sold more than half of my position. Since meme coins have their own rapid timelines, a few hours later, I decided to sell the rest.

The result? A clean 2x in 2 days.

This Wasn’t My First Rodeo: The GFT Bet

Interestingly, this wasn’t the first time my trend strength score system led me to a profitable meme coin bet. The first time was when I took a chance on GFT, a meme coin that caught my eye just as the crypto market was crashing. I detailed that experience in another blog post titled “How I Achieved a 60% Gain Amidst the Crypto Market Crash”. My system gave me the right signals, and I walked away with a 60% gain when most traders were licking their wounds.

Lessons Learned: Trading Meme Coins with a System

Trading meme coins is a risky game, and you need to act fast and have a solid process. Here’s a quick tip I observed during the testing of Trendingcoin: meme coins usually pump for 3-4 days before a significant retracement (often around 50%) occurs. So, if you see four green daily candles in a row, the next one might be the time to take some profits.

Wrapping Up

Building this trend strength score system was a labor of love (occasionally frustration), but the results have been worth it. If you’re tired of emotional, knee-jerk trading decisions and want to bring more data-driven sanity to your strategy, give trend strength scores a shot.